Mortgage Down Payment Assistance Programs

If you’re getting ready to buy a home, you’re likely focused on saving up for everything that purchase involves. One cost that’s likely top of mind is your down payment. But don’t let a common misconception about how much you need to save make the process harder than it could be.

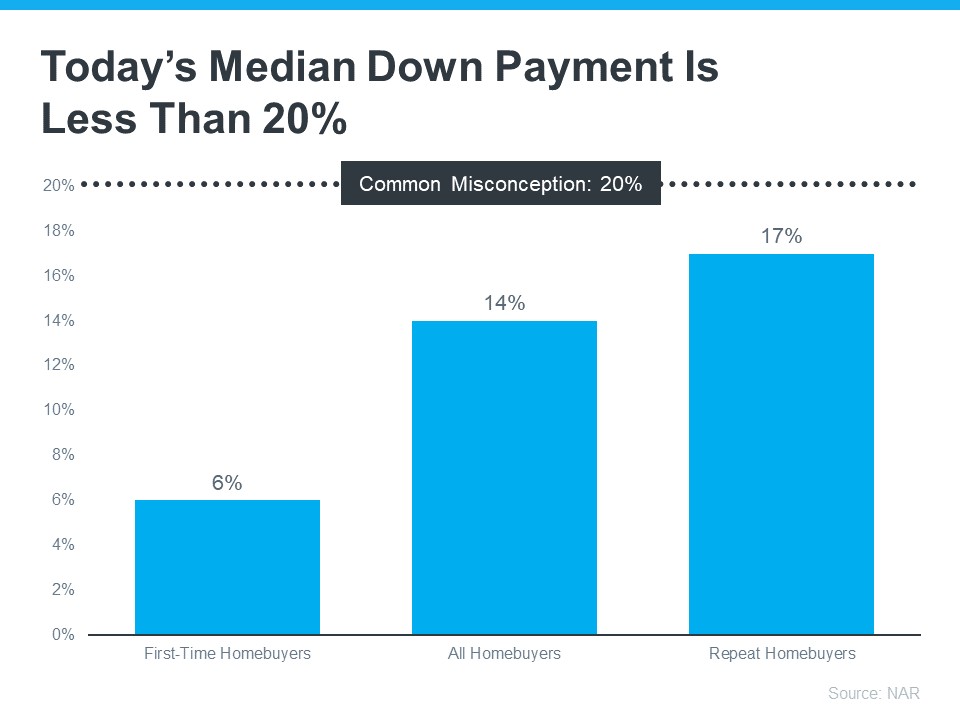

Understand 20% Isn’t Always the Typical Down Payment

Freddie Mac explains:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

Unless specified by your loan type or lender, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize. According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, the median down payment today is only 14%. And it’s even lower for first-time homebuyers at just 6% (see graph below)

Learn About Options That Can Help You Toward Your Goal

If saving for a down payment still feels like a challenge, know that there’s help available. A real estate professional and trusted lender can show you options that

could help you get closer to your down payment goal. According to latest Homeownership Program Index from Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments.

Plus, there are even loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, be sure to do your homework. Through Florida Housing, eligible borrowers can receive up to $7,500 at zero percent interest on a deferred second mortgage to use towards a down payment on a conventional loan. If obtaining an FHA, VA, or USDA loan, eligible borrowers could receive up to $10,000. There are additional down payment resources available through the Florida Hometown Heroes Housing Program, which makes homeownership very affordable for eligible frontline community workers such as law enforcement officers, firefighters, educators, healthcare professionals, childcare employees, and active military or veterans.

Bottom Line:

If you want to purchase a home this year, let’s connect. I’ll be happy to refer you to a trusted lender so we can explore your down payment options together!

“If you are thinking of buying, selling, renting out your property, or leasing real estate this year, I’d love to hear from you. Working with an experienced professional can boost your profits!” Put my 24 years of real estate experience to work for you!

Call, text, or email: 941-400-3560 or SalesInParadise@gmail.com

SPECIALTIES:

Residential & Commercial Sales & Leases, Residential and Commercial Investment Property Specialist, Senior Real Estate Specialist, New Construction, Listing & Marketing Specialist, CDPE (Certified Distressed Property Expert), Short Sale Specialist, REO/Bank Owned Sales, Golf Course Properties, Ocean Front Properties, Water Front Properties, Acreage & Farms, Vacant Land, Condos & Townhomes, Industrial/Manufacturing, Commercial Retail Properties, Association Maintained Properties, Senior Housing, Luxury Homes, Vacation and Secondary Housing.

Serving the following Florida Counties: Sarasota and Manatee