Facing Foreclosure? Know Your Alternatives

If you are behind on your mortgage payments or your mortgage is out of balance with your budget, and you want to avoid foreclosure, you’re left with a few options; Reinstatement, Loan Modification, Deed in Lieu or Short Sale.

Loan Modification:

If you prefer to keep your property, a loan modification may be a good option for you. Loan modification is a process where the terms of a mortgage are modified. Mortgages are modified to benefit the borrower and may include; reduction in interest rate, change from a floating to fixed rate, reduction in principle, reduction in monthly payment, lengthening the loan term, etc. Some lenders require that borrowers first apply for a loan modification prior to being considered for a short sale – this varies from loan type and lender.

Deed in Lieu:

Deed in Lieu is where you cooperate with the bank to essentially transfer title (ownership) back to them, hand them your keys and walk away. Sounds easy enough but most banks may require you to at least try and Short Sale the property first. Many banks aren’t interested in owning more real estate which they will then need to sell.

Short Sale:

A Short Sale is selling a property for less than the balance owed on the mortgage, and the lender accepts a discounted payoff on the mortgage to avoid a possible foreclosure or bankruptcy. Short Sales offer many benefits to both homeowners and mortgage servicers. Foreclosure is timely and costly; no mortgage servicer wants to foreclose. Some lenders even offer generous Short Sale cash incentives to entice homeowners to Short Sale.

Benefits of a Short Sale:

- Leverage to Negotiate a Deficiency Waiver & Full Debt Forgiveness

- Helps You Start Over Quickly

- Avoids the Public Humiliation of Foreclosure

- May Have a Lower Impact on Your Credit Score

- Lender May Offer Cash Back Incentives

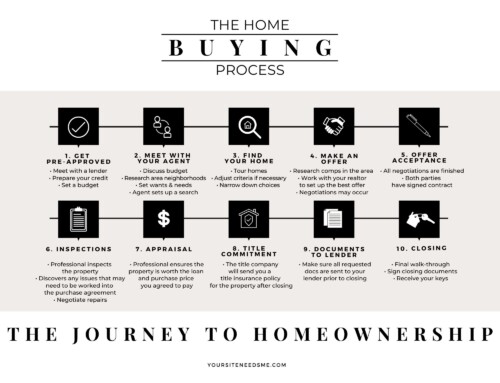

Interested? Then Let’s Get Started!

The first step any homeowner should take when considering a Short Sale is to obtain a Market Value Estimate from a Real Estate Agent. There are many significant factors to consider when listing your home as a short sale, so be sure to work with a proven professional who has a track record of successful Short Sale negotiations.

Acuity Property Group has successfully negotiated over 60 Short Sales since the last housing market crisis and are considered Short Sale Experts!

Acuity Property Group’s Listing Agents are trained “Certified Distressed Property Experts” (CDPE) and work directly with your lender to negotiate a successful Short Sale at NO COST TO YOU!

Short Selling a home requires proper planning so don’t wait until you get a Sheriff’s Sale notice to attempt a Short Sale. Speak to Acuity Property Group’s experienced staff NOW to establish your plan of action and list your home for sale, before you are deep in foreclosure proceedings.

Don’t hesitate – take action NOW! Contact Acuity Property Group to discuss your foreclosure alternatives and schedule your free, no obligation Market Value Estimate!

“If you are thinking of buying, selling, renting out your property, or leasing real estate this year, we’d love to hear from you. Working with an experienced professionals can boost your profits!”

Call, text, or email: 941-400-3560 or SalesInParadise@gmail.com

SPECIALTIES:

Residential & Commercial Sales & Leases, Residential and Commercial Investment Property Specialist, Senior Housing Specialist, New Construction, Listing & Marketing Specialist, CDPE (Certified Distressed Property Expert), Short Sale Specialist, REO/Bank Owned Sales. Golf Course Properties, Ocean Front Properties, Water Front Properties, Acreage & Farms, Vacant Land, Condos & Townhomes, Industrial/Manufacturing, Commercial Retail Properties, Association Maintained Properties, Senior Housing, Luxury Homes, Vacation and Secondary Housing.

Serving the following Florida Counties: Sarasota and Manatee