Home Buying Process Checklist (PDF) & BONUS House Hunting Checklist!

The home buying process is different in every state and sometimes even in different coutines and regions! It’s tricky, and knowing what to expect can prepare you and set the tone for a smooth buying eperience. After all, buying a home is one of the biggest financial decisions that most people will make in their lifetime. It can be an exciting and overwhelming process, especially for first-time homebuyers. To help make the process smoother, we have put together a printable PDF of the home buying process to give you a better idea of what your journey to homeonership should look like. We have also included some handy home buyer tips and a printable home buyer feature checklist that you can use to make a list of all of the features you want in a home so you can navigate the home buying process with ease.

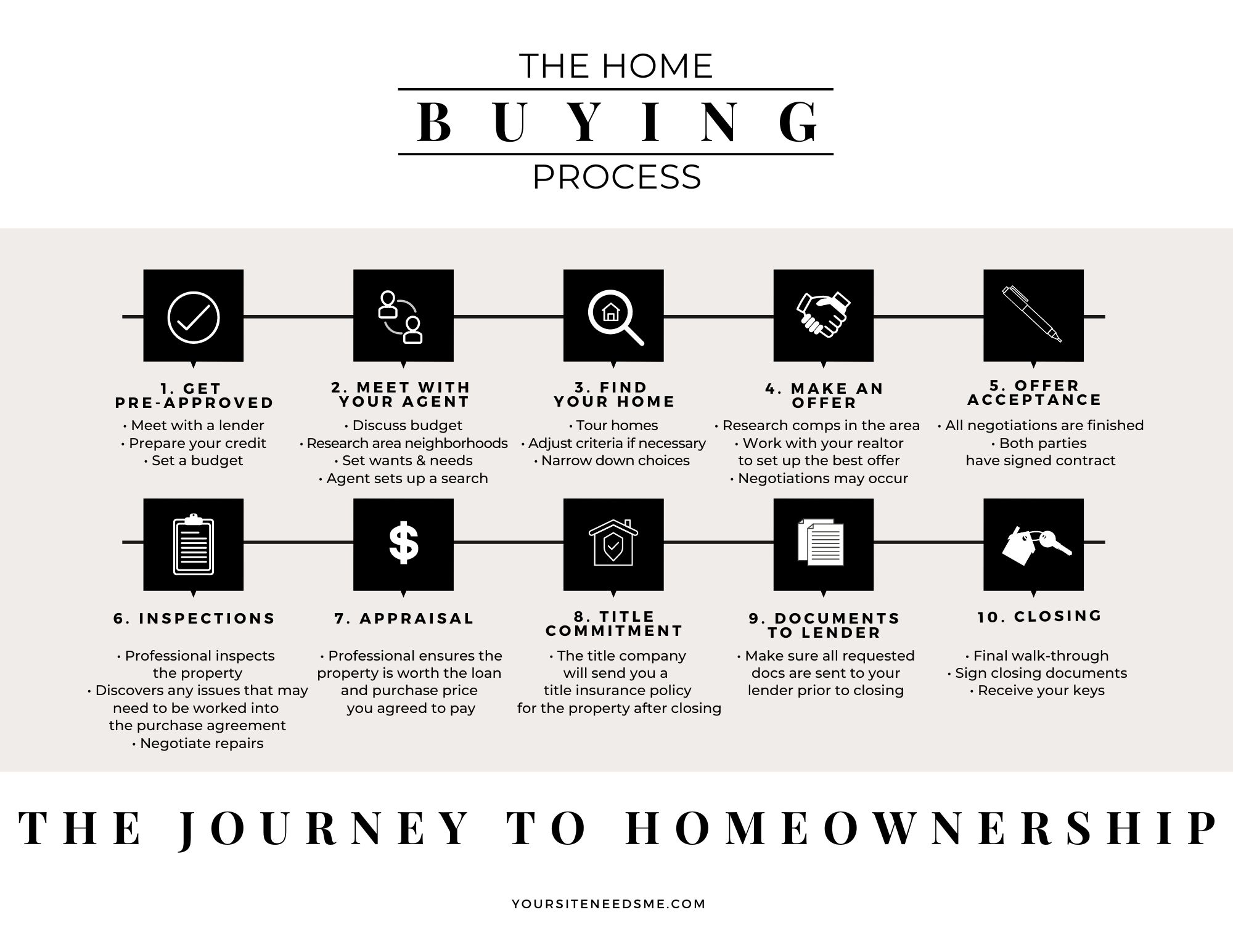

Home Buying Process Checklist:

Here are some of the major milestones in the home buying process to guide you along the way:

- Get Pre-Approved: Determine your budget to get a general idea of how much you can afford to spend on a home. You can use the Mortgage Calculator on our website or google mortgage calculator. Then meet with a lender to get pre-approved for a mortgage. If you do not know of any loan officers personally, talk to your bank or ask friends and family who they have used. Your Realtor can also give you suggestions.

- Choose a Real Estate Agent: It is important to have an experienced Realtor on your side representing YOUR best interests. Choose a real estate agent who is experienced and knowledgeable about the local market with bonus points if they know the neighborhood you want to move to. Once you have chosen a REALTOR® you can discuss your budget and what you are looking for in a home and they will then set up a property search for you or direct you to their website where you can search homes at your leisure.

- Find your Home: Search properties on a local real estate agents website (like ours!) if you want the most accurate list of available properties. Their websites are often directly connected to the MLS and are updated many times throughout the day making them the best source for new listings. Sign up for Property alerts by entering the features you want in a home and on the results page click on SAVE YOUR SEARCH so when a new property is listed, you are alerted immediately! Be sure to save your favorites as well so that if the price drops, you are notified. As you search homes you can schedule tours of properties with your real estate agent that you like so you can see them up close and personal and eliminate any that do not hold up to closer inspection. During this process you will start to narrow down your options based on your budget, location preferences, and other criteria.

- Make an offer: Once you find a property you like, make an offer through your real estate agent, and if needed negotiate with the Seller until you come to an agreement.

- Offer Acceptance: One the negotiations are complete you will both sign a purchase agreement.

- Get a home inspection: At this stage you will need to hire a professional home inspector to thoroughly inspect the property. Once complete you may go though the process of requesting some repairs before finalizing the deal.

- Home Appraisal: After the inspections are all competed your bank will want you to have an appraisal to make sure the property is worth the loan and purchase price.

- Title Company: The title company will then research your properties purchase history and ensure that there are no exisiting leins or claims on the property. If any issues are found your Real Estate Agent will be able to guide you on how to handle them. When everything is in order the Title Company will offer you title insurance which protects you and the bank against any future claims on your property.

- Send all remaining Documents to the Lender: Provide any final documents, bank statements or otherwise requested by your lender.

- Closing: On closing day you will do your final walk-through, sign the closing paperwork, usually at the Title Company’s office, and get the keys to your new home!

- Moving Day: Pack up your belongings, rent a moving truck and elist the help of family and friends because it’s finally time to make your dream a reality and move into your new home!

House Hunting Checklist

Buying a home can be a complex process, but with the right preparation and guidance, and a great checklist to guide you it can also be a rewarding experience. By using tour home buyer process checklist, you can make informed decisions and find the home of your dreams. As a bonus if you are just getting started in the home buying process then be sure to also download our printable House Hunting Checklist that you can take along with you to homes that you are interested in and keep track of the Pro’s & Cons!